San Francisco Neighborhoods Hit New Peak Values

City, State & National Long-Term Overview In this chart, one can see the recovery occurring everywhere, but most dramatically in San Francisco. For this analysis, we've calculated the 2013 SF median house sales price for the 5 months since the year began; if we looked at just the last 3 months (reflecting offers accepted in 2013, when the market accelerated further), the SF median house price jumps to about $1,000,000. (Note: State and national data sources are behind those we can access for the city, and the last median prices reflect that disparity.)

Market Report June 2013

New highs in home prices have not yet been reached in every San Francisco neighborhood, but the majority has either regained the value lost since the 2008 market meltdown, or now exceeded the previous high points of 2006-early 2008. (Different neighborhoods peaked at different times, just as they are now recovering at different speeds). This does not mean that every property bought at the height of the bubble in feverish multiple-offer bidding wars has now regained peak value. Nor does it mean that values might not fluctuate or drop in future months due to seasonal and/or other economic factors.

Though virtually every market in the country is now on a similar upward trajectory, San Francisco's has recovered more quickly than most in the Bay Area, state and country. The city's neighborhoods, with a few exceptions, were never hit as hard as most other areas by the tsunami of distressed property sales: our home values generally fell in the 15-25% range compared to huge declines of 40-60% elsewhere and so we have had less ground to recover. That said, the city has always been an exceptional real estate market and the confluence of economic factors both general (such as the lowest interest rates in history) and unique (such as the local, high-tech boom) jumpstarted and supercharged our recovery beyond most others.

It should be noted that, looking at past recoveries in the early eighties and mid-nineties, it is not unusual once a recovery gets underway after years of recession and repressed demand, for the market to regain previous peak values within a couple years of the turnaround beginning. Recoveries often start with a dramatic surge and that is what has happened with this one.

SF Houses: Previous Peak Values to Present

SF Houses: Previous Peak Values to Present

In this chart, since we're also calculating average statistics, we've capped the sales price at $3,000,000 because ultra-high-end sales usually distort averages. We see the previous peak value in 2007 (for SF houses in general), the drop to the bottom of the market in 2011, and the rebound starting in 2012 and accelerating in 2013. By all 3 main statistical measures of value, San Francisco houses have met or exceeded previous peak values. To adjust for seasonality, the comparisons are for the spring months of each year.

Short-Term Appreciation Trends

Short-Term Appreciation Trends

This chart breaks down the rise in SF home values occurring over the past 2.5 years. Though it appears that 2013 prices surged after the first quarter, the surge actually started in March, which is when the market really started to reflect offers negotiated in 2013. January and February sales mostly reflect the holiday season market, when the higher-end home market typically checks out. We prefer quarterly or longer time periods because they make for more reliable statistics: monthly statistics often fluctuate without great meaning. The high overall median prices achieved in March-May may drop somewhat during the summer due to seasonal and other factors.

2006-Present: House Values by Neighborhood

2006-Present: House Values by Neighborhood

These 4 SF Realtor districts generate a lot of house sales, so they're good for statistical analysis. For 2013, this chart looks at the last 5 months of sales-if assessing just the last 3 months, 2013 numbers would typically be higher. The central Noe-Eureka-Cole Valleys district, a hot bed of high-tech buyer demand, has soared well beyond its previous peak value in 2008. The very affluent northern district of Pacific Heights-Marina has also exceeded its previous peak. Sunset-Parkside in the southwest has regained its 2007 peak, and the southeast Bayview-Portola-Excelsior district, which was hit hardest by distressed sales, while recovering rapidly, has not yet made up the value lost since its 2006 peak. This district, with more house sales than any other, lost more percentage value in the downturn (25-45% depending on neighborhood) and so has more ground to make up. But it's well on its way.

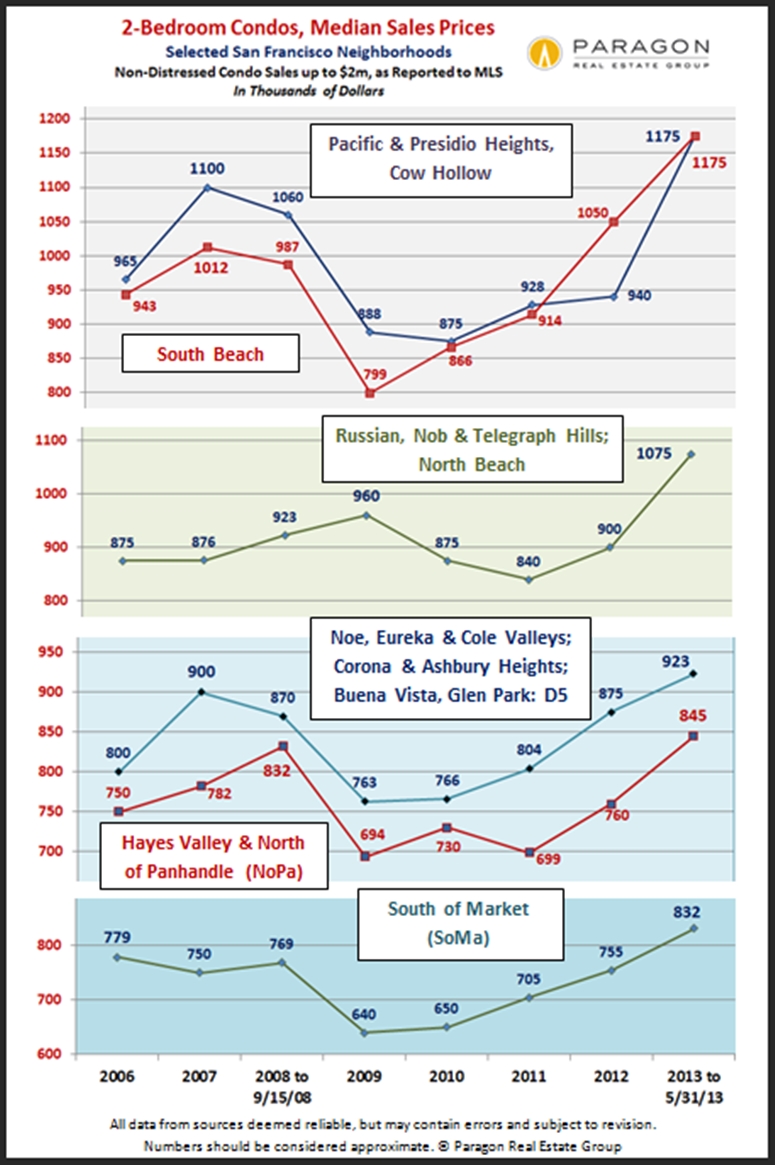

2006-Present: SF Condo Values by Neighborhood

These 6 areas of the city generate high numbers of condo sales, which is why we chose them for this analysis. Condos in all these areas have increased in value beyond their previous peaks in 2006-2008; some of them, such as South Beach, dramatically so.

2006-Present: SF Condo Values by Neighborhood

These 6 areas of the city generate high numbers of condo sales, which is why we chose them for this analysis. Condos in all these areas have increased in value beyond their previous peaks in 2006-2008; some of them, such as South Beach, dramatically so.

This link illustrates how, over the past 5 years, the SF market has switched from being dominated by house sales to condo sales; with the continuing construction of large condo projects, we expect this trend to continue. TIC sales have dropped significantly, both as a percentage of sales and in actual unit sales: This is due to a number of complex issues such as changes in city condo conversion and tenant protection regulations.

Price Range Dynamics There are 3 main underlying currents occurring in San Francisco. First is the rapid dwindling of distressed property sales: Thus, sales under $500,000, the price range of most distressed sales, have dropped by 62% since last year. This segment is on the verge of disappearing completely in SF. Second is the dramatic resurgence in luxury home sales: the affluent have profited most from the economic recovery and the city also has large numbers of the newly affluent (often high-tech) who wish to buy homes. So, sales of homes costing $1,500,000 plus have surged by 76%. The third dynamic is simply the general appreciation of home values. All 3 factors add up to a large migration from lower-priced to higher-priced sales. Note: The medians quoted on this chart are for many different property types combined.