Autumn Real Estate Season in San Francisco

Seasonality, Inventory Cycles, Median Prices & Changing Market Conditions

September 2013 San Francisco Real Estate Market Report

Is the market flattening out after its huge appreciation surge since 2012 began, or will the autumn sales season bring another step of renewed price increases?

Right now, there are some mixed signals regarding what is occurring in the San Francisco market: spring’s big jump in values vs. the recent plateau in median sales prices; interest rates that have increased significantly, but are still extremely low by historical measures; growing signs of buyer burnout with frenzied market conditions vs. supply and demand statistics that still indicate a very strong sellers’ market; and an increasing number of expired listings, which suggests that sellers may now be pushing their asking prices too high for buyers to swallow.

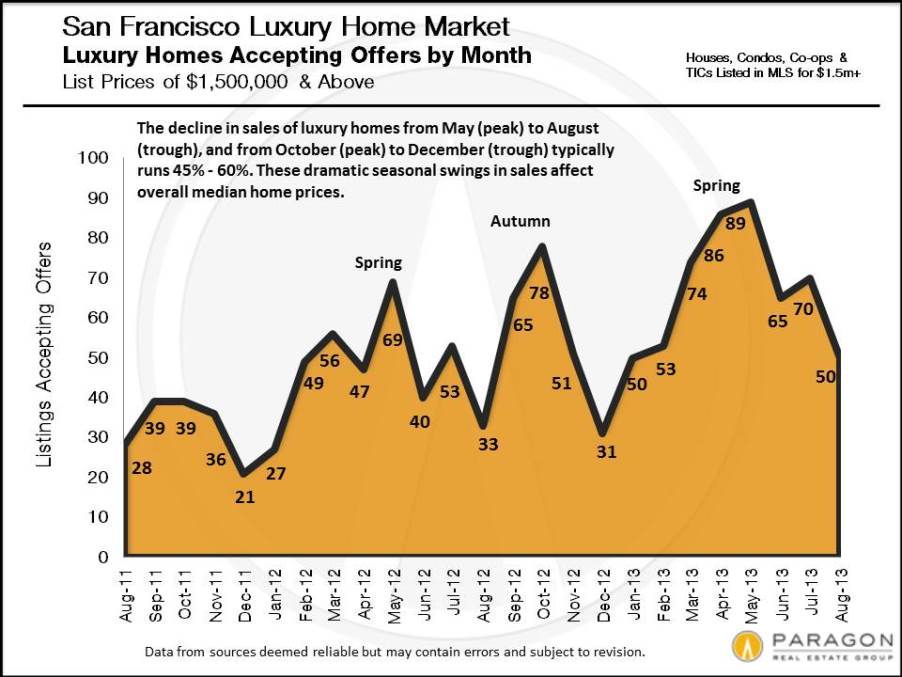

Seasonality plays a significant role in median sales prices rising in spring and autumn, and declining in summer and winter – as discussed below, much of this pertains to ebbs and flows in the luxury home market and does not necessarily reflect changes in home values. With real estate statistics, the longer-term trend is what is meaningful, not short-term fluctuations up and down. Looking at the chart above, the median sales price jogs up and down for a variety of reasons, including seasonality, but stepping back, one sees the strong, ongoing appreciation since the market recovery began.

September is typically the month with the highest number of new listings hitting the market: how buyers respond will determine what the next stage of the market will look like.

The Luxury Home Market, Seasonality & Median Sales Prices

The big surge in accepted offers for higher-price homes occurs in April/May and September/ October, when these sales make up about 14% of total home sales. The big slump in luxury home sales occurs in the summer months and in December/January, when their percentage of total sales declines to about 10%: more so than the general market, the luxury segment checks out during the summer and winter holidays. This significant decline in the ratio of high-price sales to total sales is one factor that reduces overall median home sales prices during the summer and winter holiday months.

New Listings Coming on Market

September is typically the single month of the year when the largest number of new listings comes on market. This chart illustrates the ebb and flow of new inventory by season. We shall see if this September brings the big surge in new home listings that buyers are hoping for.

August Snapshot

This chart indicates some of the mixed signals we’re seeing: on one hand, 87% of sales sold quickly without price reductions at an average sales price 8% over list price (i.e. an extremely hot market). On the other hand, the number of listings expiring or being withdrawn is climbing and so is the number of listings that has been on the market for 2 months or longer without accepting offers. Note the large difference between average days on market between homes that sell without price reductions (31 days) and homes that must be reduced before they sell (88 days): pricing, preparing and marketing properly is vital in any market.

Mortgage Interest Rates

Rates have been more or less stable since their big percentage jump in June. The increase in loan rates from their low point in 2013 is large as a percentage increase, but still leaves current rates very low from a historical perspective. The consensus of pundits seems to be that rates will be going significantly higher when and as the Fed begins tapering their huge bond-purchase program, but predicting interest rate changes is a tough game.

We’ve recently issued new or updated reports on a number of topics, which can be found online here: