Buyer / Seller Dynamics in San Francisco

All percentages are approximate: This was not a rigorously controlled survey and analysis, but more an informal poll; still we believe the data below does generally reflect market dynamics in San Francisco.

San Francisco Home Sellers

60% are selling to relocate outside of San Francisco: The main reasons, in order of prevalence, are schools (and other family-raising reasons), affordability (the ability to buy more home for the money elsewhere), job-related reasons (relocation, commute) and retirement.

15% involve trust, probate or investor sales, or people moving into rentals or retirement homes, and no new home purchase is involved.

25% are selling in order to buy another property within the city, typically either upgrading to a more expensive home or downsizing to a smaller home, or a divorce is involved.

San Francisco Home Buyers

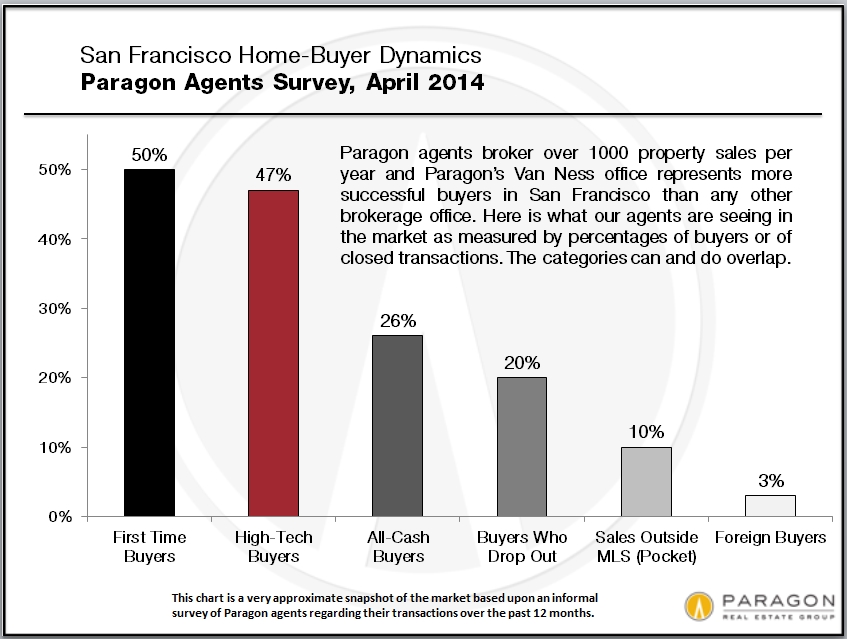

50% are first-time buyers. This is a very high percentage: In the U.S. the percentage is about 30% (and, of course, the U.S. median price is under $200k, while the SF median is over $950,000).

Average age of SF home buyers is generally getting younger and is currently in the mid-thirties.

47% of SF home buyers are employed in high tech. This is a distinctly San Francisco phenomenon related to the first 2 points above: An influx of relatively young, often newly affluent, high-tech employed, often first-time buyers – who can afford SF home prices – is playing a decisive role in the market.

20% of prospective SF home buyers have become discouraged and given up on buying in the city, due to the competitive environment and rapidly appreciating prices. They’ve either given up for the time being or shifted their home searches elsewhere.

Less than 3% of SF home buyers are foreign – exposes the myth of foreign money playing a significant role in the SF market. What purchases/investments they are making seem to be mostly in new or newer, high-rise condo developments. (There are cities in the U.S. in which large numbers of foreign buyers are having a significant impact on the market - Miami may be the most dramatic example - but SF is not one of them at this time.)

26% of homes are being purchased via “all cash” offers, though many of these offers are structured this way solely for strategic reasons to get their offers accepted in an exceedingly competitive environment. That is, many of these buyers end up getting loans either before or immediately after close of escrow. (This is a different phenomenon than investors paying all cash for distressed homes in other parts of the country – San Francisco has had very few of these sales in the past 2 years.)

Approximately 10% of home sales occur outside of the multiple listing service, i.e. as so-called off-market/ off-MLS/ pocket listings. This agrees with other analyses Paragon and others have performed.

Conclusions: To a greater extent than is probably normal, there is an exchange process occurring in San Francisco, with existing residents moving out and new residents moving in. One of the biggest reasons for selling is to relocate for better public schools outside SF or to save money by enrolling children in suburban public instead of city private schools; high prices are motivating some city homeowners to cash out to buy bigger/better homes elsewhere; frenzied market conditions are discouraging homeowners who might otherwise sell to buy other (larger, better) homes within the city – many of these homeowners are staying put out of trepidation. This last situation is affecting/lowering the supply of homes for sale.

Population/ Employment Growth and Housing

According to the latest U.S. census data, the estimated increase in the city’s population since 2010 is 32,000; over the same period, the number of employed residents has jumped by over 55,000. Per the Planning Department, the approximate number of new housing units added since 2010 is 4200. With 38% of SF’s households consisting of 1 person, and an average household size of 2.3 persons, we’re looking at over 22,000 new residents who have been looking for homes that don’t exist. This is one of the biggest factors behind the huge upward pressure on rents and home prices.

With the market recovery that began in 2012, another 6000 housing units are currently under construction and most should be ready sometime in the next 2 years. Housing units include condos (sales), apartments (rentals), houses (a very few) and community housing projects.