Buyers Challenged - Sellers Rejoice

Another Challenging Spring for Buyers

Four Angles on San Francisco Home Price Appreciation

Short-Term Trend Line: Since the Recovery Began in 2012

Longer-Term Trends: 1993 – 2015

Neighborhood Appreciation Snapshots - May 2011 – May 2015

Central Sunset, Central Richmond & Noe Valley: Median House Sales Prices

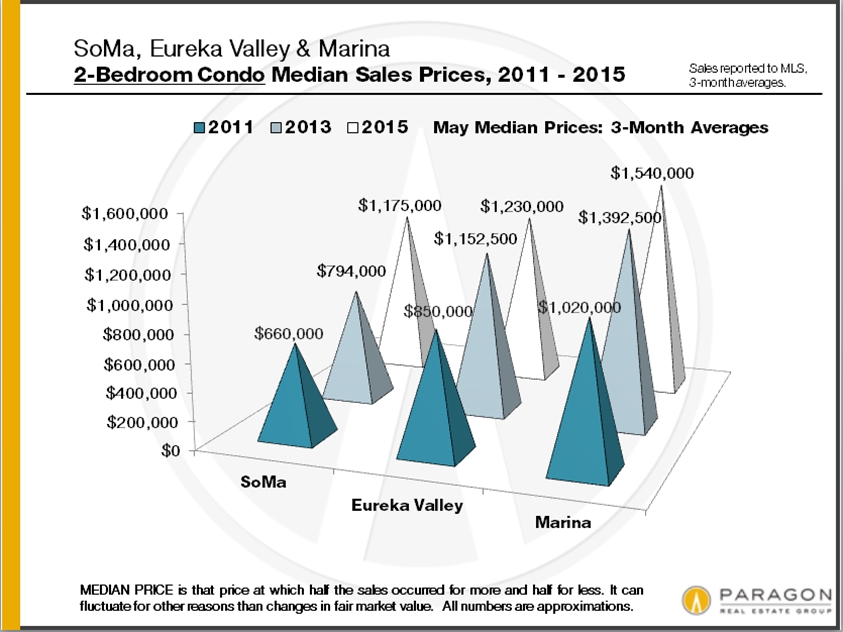

SoMa, Eureka Valley & Marina: 2-Bedroom Condo Median Sales Prices

Two of the biggest factors affecting the San Francisco real estate market are extremely low interest rates, which have a large impact on the ongoing cost of homeownership, and surging, well-paid employment. According to Ted Egan, San Francisco’s Chief Economist, high-tech jobs alone jumped by 18% in the 12 months through March 2015, and as of April, the city’s unemployment rate, at 3.4%, was the lowest since the height of the dotcom boom.

Interest rates are almost 40% below those in 2006 – 2007. With home prices having increased so much recently, future interest rate changes will be something to watch carefully for their impact on affordability. Rates have been inching up recently and just hit 4% for the first time in 2015, but they are still very low by any historical measure.