Interest Rates Are Rising. What Does That Mean for You?

Photo by Marco Verch Professional Photographer on Flickr via Creative Commons license

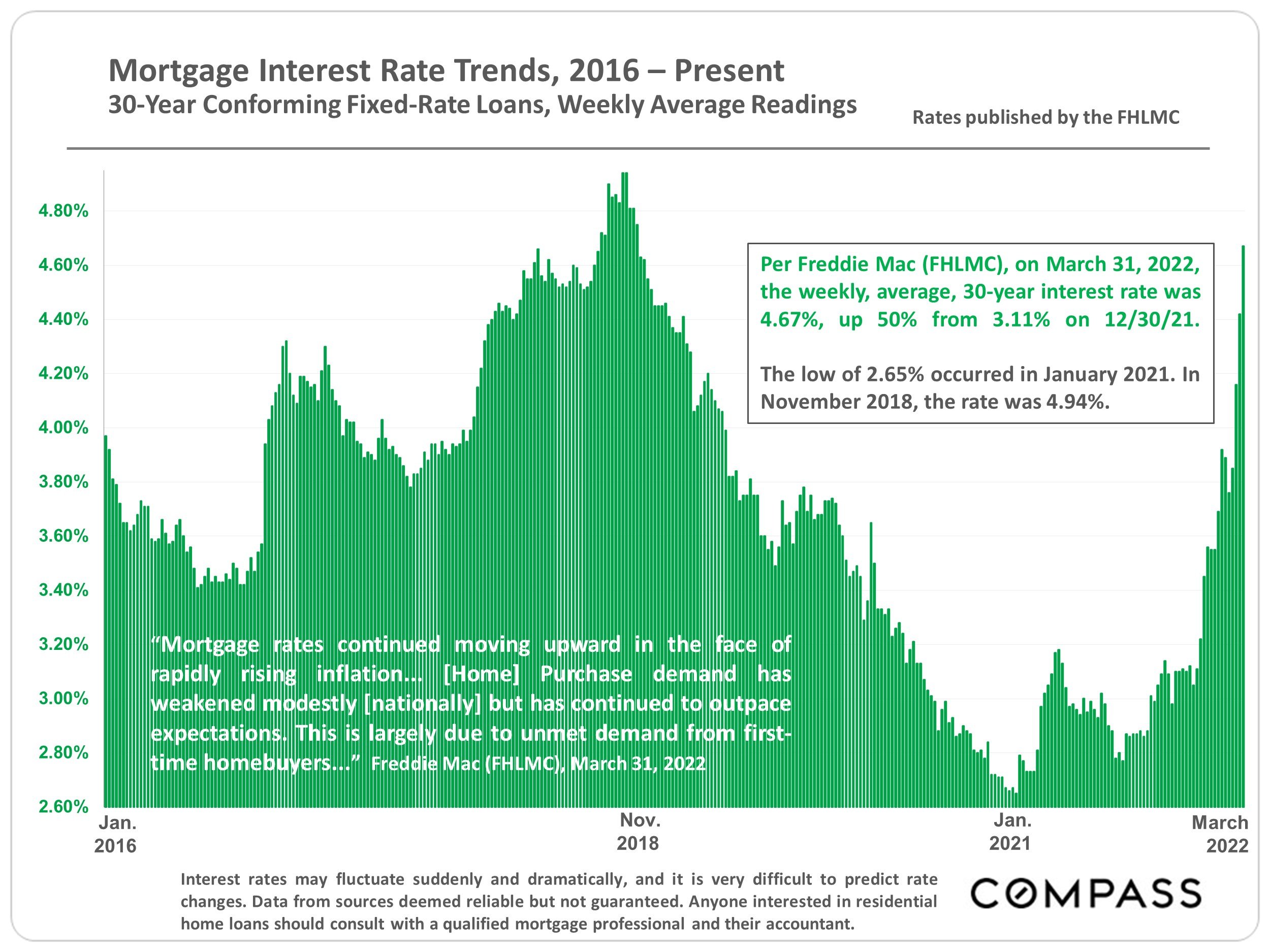

The biggest thing impacting the real estate market these days is the seemingly sudden increase in interest rates. After hitting a historic low in January 2021, interest rates have been on the rise off and on, and in the past few weeks they’ve really accelerated, as evidenced in this chart:

Mortgage Interest Rate Trends, 2016-present

So why is the Fed raising interest rates? When rates are down, money is cheaper and easier to get, which in turn drives consumer demand. Increased demand — in particular when combined with current issues like supply chain and staffing complications — drive up inflation, making goods and services more expensive. So when inflation is on the rise, the Fed typically raises interest rates to let some of the air out of the consumer demand balloon. Higher interest rates decreases consumer buying power.

The way increased rates erodes buying power can be seen in these two examples. In the first, we see what would be the monthly principal and interest payments on a jumbo loan of $1,800,000 for a $2,300,000 property. if the buyer had gotten the loan a few weeks ago at 3%, the payments would be $7,558. 57. Today, at a more realistic 5.375% rate, the monthlies would be more than $10,000, and if rates hit 7% — which seems very likely — that jumps to almost $12,000.

| Interest rate | 3% | 5.375% | 7% |

|---|---|---|---|

| Price/Value | 2,300,000 | 2,300,000 | 2,300,000 |

| Principal & Interest | $7,588.57 | $10,079.48 | $11,975.44 |

Even on a smaller conforming loan, the impact of increased rates is notable.

| Interest rate | 3% | 5.375% | 7% |

|---|---|---|---|

| Price/Value | $610,000 | $610,000 | $610,000 |

| Principal & Interest | $2,057.43 | $2,847.84 | $3,246.68 |

The bad news is that higher interest rates makes housing less affordable. The good news is that this in turn typically means fewer frenzied buyers, and probably less overbidding. In other words, this potentially sets the stage for a buyer’s market.

That said, San Francisco is already a very expensive real estate market, and generally always has at least some pent up demand, especially for first-time home buyers. So even if increased interest rates deter rampant overbidding, the baseline still can make for high monthly mortgage bills.

If you’re among those whose place of employment allows for fully remote work, this may be a good time to start looking in other markets, whether as your primary residence or as a getaway. Yes, sometimes it’s a good idea to buy your second home first.

Another option is to look at investment properties. After taking a hit in the early days of the pandemic, rents have rebounded, often meeting or exceeding pre-pandemic levels. Nationally, median rent rates jumped 17% in the last year. Multi-unit buildings often have more bang for buck than single-family homes or condos, so as long as the capitalization rate, or the rate of return versus the cost of owning, is sufficiently high, this can be a good way to get into the market, even with higher rates.