Building Wealth via Home Ownership

The market just begins to wake up in January, so its statistics are not particularly illuminating. The last 3 springs in San Francisco saw frenzied markets, which took its home values to new heights. While waiting to see what develops in 2015, but most likely it will be another crazy year! Buying property in San Francisco can be daunting, especially with these prices. Looking back over the past twenty years, housing tends to be a good long term investment.

San Francisco Median Sales Prices, 1993 – 2014

Unit Sales Trends by Property Type

The second chart above illustrates sales volume by property type. Houses turn over much less often than condos or TICs – i.e. house owners generally live in their homes longer before selling – and with virtually no new houses being built in the city, house sales as a percentage of total sales are declining, but this has also made them the market’s highest-demand, most competitive segment. Condos now dominate SF home sales and will continue to do so with the many new-condo projects being built. TIC sales are down almost 60% from 2007, probably due to financing conditions and changes in condo conversion and tenant eviction laws. The number of listings fell last year putting additional pressure on the market.

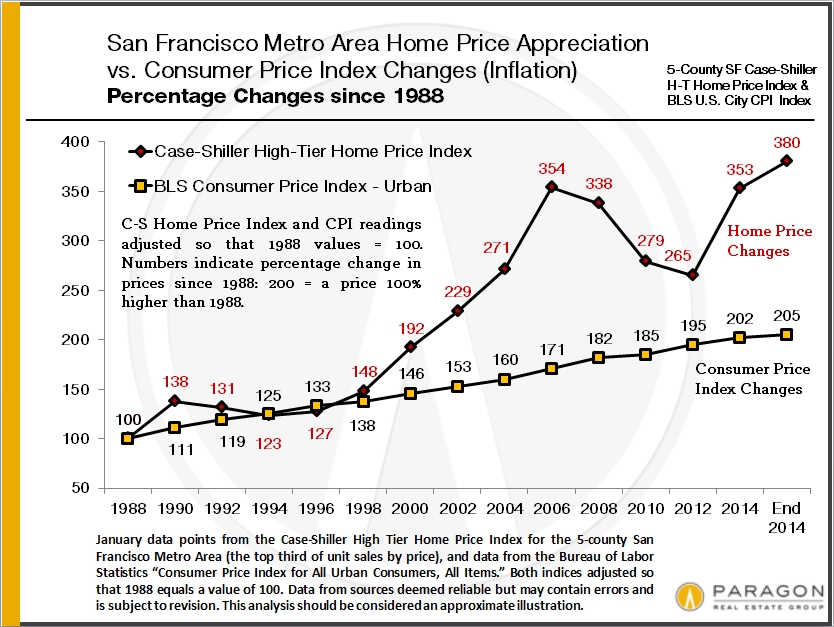

Home Appreciation vs. Inflation

Since 1988, home price appreciation has hugely outpaced CPI inflation, though as seen below, the difference can swing dramatically depending on the exact point within a financial cycle. On a cash investment basis, if you had put $100,000 down on a $500,000 home purchase with a 30-year loan in 1988, by the end of 2014, per the Case-Shiller Index, your home would be worth approximately $1,900,000. After deducting 7% closing costs and paying off the remaining loan balance, your $100,000 down-payment turned into approximately $1.65 million in proceeds (if you didn’t continually refinance out your growing equity to buy new toys).

This is a very simplified calculation of a complex financial scenario that includes leverage, financing terms and interest rates, inflation, appreciation, multiple tax benefits and housing costs – you should talk to your accountant – but it still illustrates why a recent New York Times op-ed piece (11/30/14, “Homeownership & Wealth Creation”) said, “Renting can make sense as a lifestyle choice or because of income constraints. As a means to building wealth, however, there is no practical substitute for homeownership.”